Ivane Javakhishvili Tbilisi State University

Paata Gugushvili Institute of Economics International Scientific

GEORGIAS ECONOMIC GROWTH AND FOREIGN DIRECT INVESTMENT CONNECTION

Annotation. Macroeconomics determines the priorities of a country. In the light of ongoing economic crises, this subject becomes more and more topical. Especially when all economists and politicians search the answers for the following questions: Why did such a serious economic crisis occur? How long will the recession continue? What additional political or economic tools can be used in order to solve the current problems? The ongoing economic crises, natural economic changes, tendencies of growth and decline have a significant impact on the formation of the macroeconomic policy. In order to avoid consequences of misinterpreted macroeconomic policy, it is important to properly assess and understand the potential and direction of a state. It is crucial to correctly determine the macroeconomic priorities for Georgia, which, in addition to the fact that is a state with young market economy, has to deal with a lot of social and economic problems.

Keywords:Economic growth; Foreign Direct Investment

Introduction

It is impossible to achieve an economic growth without proper planning of macroeconomic parameters. Macroeconomics determines the priorities of a country.

In the light of ongoing economic crises, this subject becomes more and more topical. Especially when all economists and politicians search the answers for the following questions: Why did such a serious economic crisis occur? How long will the recession continue? What additional political or economic tools can be used in order to solve the current problems? The ongoing economic crises, natural economic changes, tendencies of growth and decline have a significant impact on the formation of the macroeconomic policy. In order to avoid consequences of misinterpreted macroeconomic policy, it is important to properly assess and understand the potential and direction of a state. It is crucial to correctly determine the macroeconomic priorities for Georgia, which, in addition to the fact that is a state with young market economy, has to deal with a lot of social and economic problems.

Research on the topic

During the last decade, the average annual growth rate in Georgia was 6.9%, which is pretty high. It was mostly the result of the first-generation reforms.

- Macroeconomic Parameters

|

2010 |

2011 |

2012 |

2013 |

2014 |

2015 |

2016* |

|

|

GDP in current prices, mln. Gel |

20743.4 |

24344.0 |

26167.3 |

26847.4 |

29150.5 |

31755.6 |

33921.6 |

|

GDP perpetually in 2010 prices, million GEL |

20743.4 |

22241.4 |

23653.8 |

24454.9 |

25585.6 |

26322.5 |

27044.8 |

|

GDP real growth, percentage change |

6.2 |

7.2 |

6.4 |

3.4 |

4.6 |

2.9 |

2.7 |

|

GDP deflator, percentage change |

8.6 |

9.5 |

1.0 |

-0.8 |

3.8 |

5.9 |

4.0 |

|

GDP per person (in current prices), gel |

4675.7 |

5447.1 |

5818.1 |

5987.6 |

6491.6 |

8550.9 |

9117.7 |

|

GDP per person (in current prices), USD |

2623.0 |

3230.7 |

3523.4 |

3599.6 |

3676.2 |

3766.6 |

3852.5 |

|

GDP in current prices, mln. USD |

11636.5 |

14438.5 |

15846.8 |

16139.9 |

16507.8 |

13988.1 |

14332.8 |

Information Source: http://www.geostat.ge

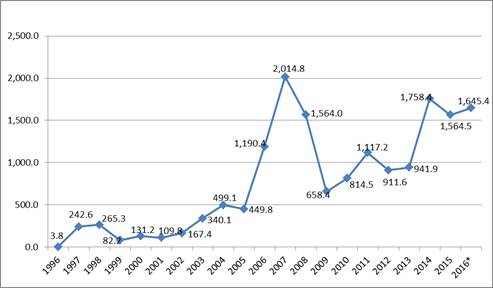

For last 20 years, the total sum of the direct investments in Georgia was 16 472. 4 million USD. Foreign investment is one of the ways to achieve an economic growth in the country. Foreign investment increases existing supply of capital in the country, hence ensuring the higher level of production and employment. Foreign investments give the developing countries the opportunity to get acquainted with and use the newest technologies, which are produced and used in countries with developed economy.

According to the preliminary data of the first quarter of 2016, Direct Foreign Investment in amount of 376.4 million USD was made in Georgia. It is worth mentioning that, according to the first quarter data, the maximum amount of Foreign Direct Investment in amount of 537.7 million USD was made in 2008. Whilst in 2009 the amount of FDI was significantly decreased (114 million USD) due to a war. It started to increase again in following years.

- Direct foreign investments, million USD (1996-2016):

Information Source: http://www.geostat.ge

According to the investments made in Georgia, top five investor countries are as follows: Azerbaijan (136.9 million USD), Turkey (56.5 million USD), United Kingdom (44.2 million USD), Korea (32.1 million USD), Netherlands (21.5. million USD). Korean investment played a big role in forming the size of FDI of the first quarter of 2016, because Korea made its first investment of this size in 2017. As for the other countries, if we look at the data of past 10 years, they always were in the list of top five countries. According to the total sum of past 10 years, 12% of FDI comes from Netherlands, 11% from Azerbaijan, 10% from UK, 7% from Turkey and 7% from USA.

- Foreign Direct Investments in Georgia From 1996 to 2016 (Thousand US Dollars):

Information Source: http://www.geostat.ge

It is also important which sectors of the country are more appealing to the investors and accordingly which sectors are developing with the support of foreign investments. According to the data of the first quarter of 2016, more than half (53%) of the investments, comes to the transport and communications sector. The second most important sector for the investors is the financial sector, 15% of the investments made in the first quarter of 2016 comes to that sector and the energy sector takes the third place (11%).

Transport and communications sector was the most appealing to the investors not only in the first quarter of 2016 but the most part of the investments made in last ten years comes exactly to the sector of transport and communications. Significant Foreign Direct Investments are made in the energy and financial sectors. It is worth mentioning that the most FDI was made in the sector of transport and communications. The construction sector has the highest growth rate of investments.

- Foreign Direct Investment According to Economic Sector

2007-2016(Thousand, USD):

Information Source: http://www.geostat.ge

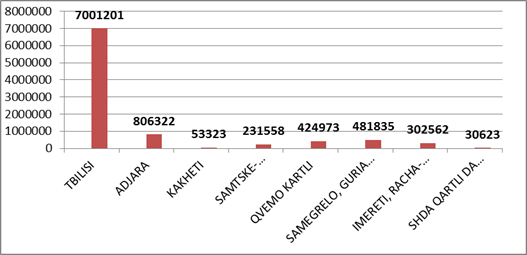

As for the regional development, according to the data of the first quarter of 2016, the biggest part of the FDI (63%) comes to the capital Tbilisi, 18$ of the entire FDI was made in Adjara, 15% was made in Samegrelo-Zemo Svaneti.

- According to the Direct Foreign Regions of Georgia 2009-2016 (thousand, USD):

Information Source: http://www.geostat.ge

Characteristics of the development of macroeconomics in Georgia are very interesting. It is common in Georgia for private sectors to be interested in the traditional sectors. It can be said, that in general, new industrial directions were never discovered nor developed. The investment boom continues in the traditionally popular sectors, which causes their so-called overheating and non-effectiveness of the investments. Traditional sectors are residential and commercial real estate, hypermarkets, commercial banks, pharmacies, petrol stations. According to the research conducted by the World Bank in Georgia, new companies tend to enter the already sated and competitive markets with the same products (the World Bank, 2013).

It has to be mentioned that developed banking sector, which is an auxiliary field, naturally, specializes in the providing low-risk and short-term capitals and credits already discovered fields. Thus, this cannot play the main role in the structural transformation of the economy. According to the international practice, in this model of growth, taking into consideration the role of the state, it is doubtful for the capital market to play the significant role without the targeted economic policy, especially when the lack of market and savings as well as non-existence of the relevant infrastructure are important obstacles for the development. We can sum up that Georgian economy is developing through the overall accumulation of fundamental opportunities, which is a slow and expensive process. According to the international practice, in order to move to structural transformation model of the economic growth, existence of the industrial policy is a necessary precondition. It is important to determine at what stages and in what sequence the industrial policy, which is directed to the growth of employment and increase of the productivity, should be implemented. Taking into the consideration the existing challenges, Georgia’s initial focus should be on maximising the existing resources.

The globalization process provides the developing countries with the opportunity of rapid economic growth through the access to the international trade and capital. Accordingly, the significance of Foreign Direct Investment is increased with this process. FDI gives foreign investors the opportunity to use the assets more effectively, while giving the recipient countries the opportunity to assimilate with the better technologies, participate in international production and trading process.

In order to attract more FDI, the developing countries massively liberalised the investment regimes in past ten years, because an attraction of the investments is considered as an auxiliary factor for the economic development, modernisation, increased employment and growing income.

Resume

Despite the lot of advantages, the FDI may have negative results for the economy of the receiving country. Let's shortly sum up the negative and positive impact of the FDI on the recipient country:

Economics and foreign trade

The positive effect of the FDI is its positive impact on the economic growth by increasing an effective use of overall productivity of economic factors and resources. Foreign investments increase the size of the capital in the country thus supporting the growth of production. It also supports the integration of the recipient country with the global economics by increasing the foreign trade.

Developing the human capital

FDI increases the employment and is very important for the development of the human capital. Due to the high productivity, this type of employment means higher salaries and better working conditions. Technological know-how and progressive management enable the establishment of such type of production in global markets.

Spillover effects

One of the major positive effects of Foreign Direct Investment is the effect of a significant technological spillover on other sectors in the recipient country. The local companies can increase the productivity through the access to the modern and improved technologies. Foreign Direct Investment also increases R&D initiatives of the local companies.

Competition level

Foreign Direct Investment increases the competition level on the local market and this way it contributes to high productivity, innovations, relatively slow priced and effective distribution of the resources.

Effect of expulsion of the domestic investments

Foreign Direct Investment may have the effect of the expulsion of the local investments. In countries where investments are made in direction of assimilation of the local market, the local companies meet significant competition because the companies created by the foreign investment increase the production size and attract the customers due to low expenditure margin. Because of the lack of demand, the local companies decrease the size of production and their fixed expenditure grows on one unit production. However, if the investment is directed to the export production, the effect of the expulsion of the local investment becomes a less problem.

Generally, the expulsion of the local investment happens due to two main reasons: Firstly, when local firms disappear because of the high productivity and quality of the foreign competitors and secondly because of the fact that the foreign competitors have better access to the financial resources and external market. In the first case the effect is positive for the country, because only the companies with the high productivity and quality stay on the market. However, in the second case there is a social loss, which shall be eliminated through supporting the small and medium local businesses.

Current account balance despite of the fact that the foreign investments are the direct financial source of the current account deficit; they may have negative impact on the current account during the mid-term period. The main objective of the foreign investor is to gain as much profit from the investment as possible. Some of the advantages of the recipient countries (cheap labour, natural resources etc.) give the investor opportunity to have a successful business. Very often, the obtained result leaves the country as a divided profit, which has a negative impact on the payment balance. In addition, the foreign investments often refurbish the import and if it is not directed to the production of the export product then it worsens the current account balance.

Conclusion

Despite the contradictory effects discussed, it is considered that the impact of the Foreign Direct Investment on the economics of the recipient country is positive, however, various countries use the investments in different ways. Foreign Direct Investment does not primarily mean advantage or disadvantage, its positive impact depends on the recipient country. It depends on how optimally the recipient country will use the benefits of the direct investment.

References

- www.statistics.ge

- James D. Gwartney, Macroeconomics, Private and public Choice, 13th edition, 2015.

- Economic Indicators, Maiking Sence of Indicators, Sixth Edition, Bloombering Press, Ne York, The Economist, ISBN-13: 978-1-57660-240-9 (alk. paper);

- Reaser Methodology In Applied economics, Orgsnizing, Planing, and Conducting Economic Reasearchdon Ethridge, Blackwell Publishing,Lowa State University of Amerika, second Edition, 2004, ISBN-0-8138-2994-19 (alk. paper)

- Reaserch Methods, Jack R. Nation, Prentice Hall, Upper Saddle River, N.J.07458, 1996, by Prentice-Hall, Inc. ISBN 0-02-386132-0

Summary

Despite the lot of advantages, the FDI may have negative results for the economy of the receiving country. Let's shortly sum up the negative and positive impact of the FDI on the recipient country. Positive effect: Economics and foreign trade; Developing the human capital; Spillover effects; Competition level.

Current account balance despite of the fact that the foreign investments are the direct financial source of the current account deficit; they may have negative impact on the current account during the mid-term period. The main objective of the foreign investor is to gain as much profit from the investment as possible. Some of the advantages of the recipient countries (cheap labor, natural resources etc.) give the investor opportunity to have a successful business.

Despite the contradictory effects discussed, it is considered that the impact of the Foreign Direct Investment on the economics of the recipient country is positive, however, various countries use the investments in different ways. Foreign Direct Investment does not primarily mean advantage or disadvantage, its positive impact depends on the recipient country. It depends on how optimally the recipient country will use the benefits of the direct investment.

Despite the lot of advantages, the FDI may have negative results for the economy of the receiving country. Let's shortly sum up the negative and positive impact of the FDI on the recipient country:

One of the major positive effects of Foreign Direct Investment is the effect of a significant technological spillover on other sectors in the recipient country. The local companies can increase the productivity through the access to the modern and improved technologies. Foreign Direct Investment also increases R&D initiatives of the local companies.

Foreign Direct Investment increases the competition level on the local market and this way it contributes to high productivity, innovations, relatively slow priced and effective distribution of the resources.

Foreign Direct Investment may have the effect of the expulsion of the local investments. In countries where investments are made in direction of assimilation of the local market, the local companies meet significant competition because the companies created by the foreign investment increase the production size and attract the customers due to low expenditure margin. Because of the lack of demand, the local companies decrease the size of production and their fixed expenditure grows on one unit production. However, if the investment is directed to the export production, the effect of the expulsion of the local investment becomes a less problem.

Generally, the expulsion of the local investment happens due to two main reasons: Firstly, when local firms disappear because of the high productivity and quality of the foreign competitors and secondly because of the fact that the foreign competitors have better access to the financial resources and external market. In the first case the effect is positive for the country, because only the companies with the high productivity and quality stay on the market. However, in the second case there is a social loss, which shall be eliminated through supporting the small and medium local businesses.

Despite of the fact that the foreign investments are the direct financial source of the current account deficit; they may have negative impact on the current account during the mid-term period. The main objective of the foreign investor is to gain as much profit from the investment as possible. Some of the advantages of the recipient countries (cheap labour, natural resources etc.) give the investor opportunity to have a successful business. Very often, the obtained result leaves the country as a divided profit, which has a negative impact on the payment balance. In addition, the foreign investments often refurbish the import and if it is not directed to the production of the export product then it worsens the current account balance.